What is a Trust Protector in California?

- Linda Varga

- Sep 7

- 3 min read

Introduction

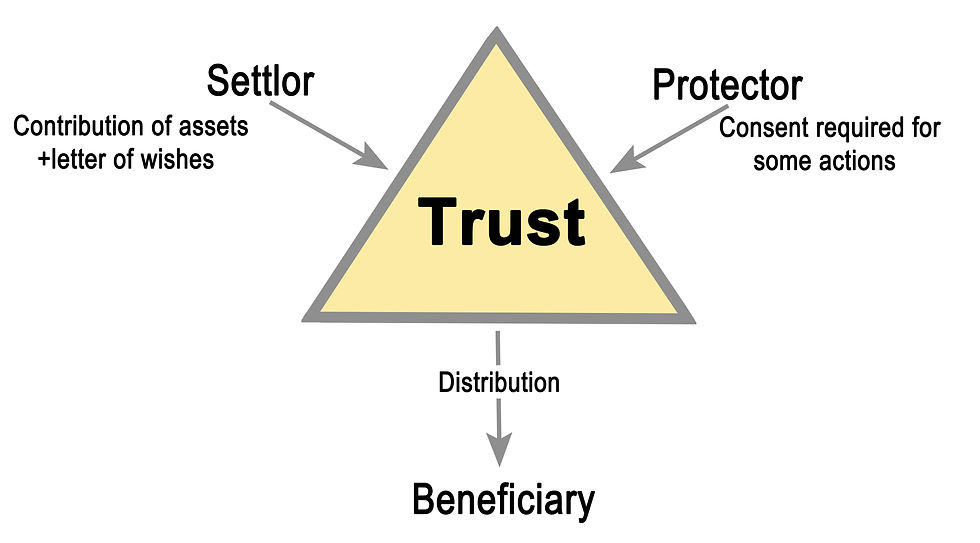

In today’s world of estate planning, flexibility and oversight are crucial. Traditional trusts often grant broad authority to a trustee, but what happens when unforeseen complex family dynamics, new tax laws, or changing circumstances arise? That’s where the role of a trust protector becomes invaluable. A California trust protector is not a trustee but an independent party with special powers designed to safeguard the trust’s purpose and ensure long-term effectiveness.

Defining the Trust Protector: A Modern Estate Tool

A trust protector is an appointed individual (or sometimes a trust committee) who provides oversight, direction, and checks on the trustee’s actions. Unlike the trustee vs trust protector relationship, where trustees handle day-to-day trust administration, protectors hold specific powers such as:

Modifying trust provisions to adapt to law changes

Appointing trustee or removing trustee when necessary

Resolving disputes among beneficiaries or between the trustee and beneficiaries

Approving trustee actions in high-risk or sensitive matters

The concept was strengthened by the California UDTA 2024, which aligns with the Uniform Directed Trust Act (UDTA). This legislation recognizes directed trusts, allowing trust directors or trust advisors to give binding instructions to trustees.

Trust Protector Duties and Powers:

The powers of a California trust protector can be as broad or as narrow as the trust document allows. Under the California Probate Code Sections 16600–16632, trust protectors may act with fiduciary duty and be held accountable for improper actions.

Common Trust Protector Duties:

Modifying trust for tax purposes to maximize efficiency

Correcting trust mistakes, such as drafting errors

Interpreting trust terms when language is unclear

Terminating trust if its goals can no longer be achieved

Altering beneficiary interest to adjust distributions

Removing a beneficiary or adding a beneficiary under specific conditions

Arbitration of trust disputes to prevent costly litigation

Trust Protector Powers May Include:

Trust oversight to ensure compliance with law and intent

Exercising powers of direction over investments or distributions

Supervising directed trustee actions in directed trust arrangements

Monitoring trust advisor or trust director roles for accountability

These powers balance estate plan flexibility with inheritance protection, offering both adaptability and security.

Trust Protector Benefits: Why They Matter in California

The benefits of appointing a trust protector go far beyond legal compliance. They offer peace of mind and adaptability in an unpredictable world.

Key Benefits Include:

Estate plan flexibility to address new laws or tax codes

Privacy in estate planning by avoiding public probate court battles

Inheritance protection for vulnerable beneficiaries

Long-term trust management ensures the trust adapts over decades

Asset protection by overseeing risky or conflicted transactions

In California estate law, this role is particularly valuable for family business succession, real estate partnerships, or when trusts hold assets that require ongoing monitoring.

Trust Protector Risks and Potential Conflicts

While the role is powerful, it is not without risks. Like trustees, protectors can face challenges:

Conflicts of interest if too closely aligned with certain beneficiaries

Trust protector risks of overstepping authority or neglecting duties

Removing a trust protector may become necessary if abuse occurs

Unclear boundaries between the trustee and the protector may cause friction

Proper drafting of trust documents and clear definitions of trust protector powers can minimize disputes and ensure smoother trust administration.

Trustee vs. Trust Protector: Drawing the Line

It’s vital to distinguish between these two roles:

Trustee Duties: Day-to-day management, asset distribution, accounting, tax filings, and fiduciary obligations to beneficiaries.

Trust Protector Duties: Oversight, corrective actions, dispute resolution, and ensuring the trust remains relevant and aligned with the grantor’s vision.

Think of the trustee as the driver of the vehicle and the trust protector as the navigator—ensuring the journey stays true to the intended path.

The Future of Trust Protectors in California

With the implementation of the California UDTA 2024, directed trusts and trust oversight mechanisms will become even more significant. Families are increasingly incorporating trust protectors into their estate planning to balance flexibility with accountability.

This growing reliance shows that trust protectors are not just optional add-ons but essential guardians of modern wealth transfer strategies.

Conclusion

A California trust protector serves as the ultimate safeguard in trust administration. From modifying trust provisions to resolving disputes and ensuring compliance with California estate law, they bring balance to the delicate relationship between trustees and beneficiaries.

If you are drafting or reviewing a trust, consider the value of appointing a trust protector. Their oversight may prevent costly mistakes, protect beneficiaries, and keep your estate plan adaptable for generations.

📞 Call our experienced estate planning team today to learn how a trust protector can strengthen your plan and protect your family’s future.

Comments